The NIACL AO Interview is the final and most decisive stage of the NIACL AO recruitment process for the 2025–26 cycle. Candidates who have qualified the written examination are shortlisted for the interview round, which plays a crucial role in determining the final merit list. The interview is conducted to assess a candidate’s personality, communication skills, subject clarity, awareness of the insurance and banking ecosystem, and overall suitability for a responsible officer-level role in a public sector insurance organization.

For the NIACL AO 2025–26 recruitment, the interview is expected to be conducted between January and February 2026. Since the interview carries significant weightage in the final selection, candidates must prepare in a structured and focused manner.

NIACL AO Interview Process 2025–26

The NIACL AO interview is the final stage of selection after the written examination. It is conducted in the form of a panel interview, where candidates are assessed by senior officials and subject experts. The panel evaluates candidates on subject knowledge, confidence, communication skills, professional attitude, and awareness of banking and insurance. Final selection is based on the combined marks of the written examination and interview, as per the official weightage.

Must know information about NIACL Before the AO Interview

Before appearing for the NIACL AO interview, candidates must have a clear understanding of NIACL as an organization, its history, scale of operations, financial performance, product portfolio, and role in India’s general insurance sector. Interview panels often expect candidates to be aware of basic company facts, recent performance trends, and NIACL’s market position. The table below highlights the most important NIACL facts that every NIACL AO aspirant must know before the interview.

| Item | Updated Facts |

| Full Name | New India Assurance Company Limited (NIACL) |

| Founded | 1919 |

| Founder | Sir Dorabji Tata |

| Headquarters | Mumbai, Maharashtra |

| Ownership | Government of India |

| Governing Ministry | Ministry of Finance, Government of India |

| Type of Insurer | Public Sector General Insurance Company |

| Regulator | Insurance Regulatory and Development Authority of India (IRDAI) |

| CMD (Recent) | Girija Subramanian |

| Market Position | Largest general insurance company in India |

| Presence in India | Extensive pan-India branch network |

| Overseas Presence | Operations in Asia, Africa, Middle East & Australia |

| Major Insurance Products | Motor, Health, Fire, Marine, Crop, Liability Insurance |

| Gross Written Premium | ~₹43,618 crore (FY 2025) |

| Market Share | ~12.6% (FY 2025) |

| Q2 FY 2025–26 Revenue | ~₹13,341.90 crore |

| Recent Profit Trend | Pressure on profitability despite revenue growth |

| Key Government Schemes | Crop insurance, health insurance, social security schemes |

| AO Role Areas | Underwriting, Claims, Marketing, Finance, HR, IT |

| Core Strengths | Risk management, wide reach, public trust, legacy |

What personality-based questions are asked in the NIACL AO interview?

In the NIACL AO interview, personality questions are asked first to assess confidence, clarity of thought, communication skills, attitude, and long-term suitability for an officer’s role. These questions are conversational but deeply evaluative.

- Tell me something about yourself.

- Why do you want to join the banking/insurance sector?

- Why do you want to join NIACL?

- How is your degree relevant to the banking or insurance industry?

- How is banking/insurance better than your present job? (for working professionals)

- Tell us about your strengths and weaknesses.

- How can you prove yourself as a valuable asset to NIACL?

- Will you leave this job if you get a better opportunity in the future?

- What qualities should an administrative officer possess?

- Do you think you have those qualities?

- Questions related to your home state (economy, culture, famous places).

- Questions related to your district or city.

- Why should we select you over other candidates?

- Where do you see yourself five years from now?

- Are you comfortable with transfers anywhere in India?

What banking awareness questions are asked in the NIACL AO interview?

Banking awareness questions are asked to test your basic understanding of the financial system, banking operations, and economic concepts that are closely linked with insurance.

- What are CRR, SLR, repo rate, reverse repo rate, bank rate, and NPA?

- What is the difference between CRR and SLR?

- What is the difference between repo rate and reverse repo rate?

- Why does RBI change repo rates?

- What do you understand by commercial papers?

- What are the different types of bank accounts?

- What is the difference between a fixed deposit and a recurring deposit?

- How does a bank generate revenue?

- What are the reasons for rising inflation in India?

- What is the difference between inflation and deflation?

- What do you know about the share market?

- What is fintech?

- What is e-commerce?

- Is a bank merger a good option?

- What do you understand about NPA?

- What is NABARD?

- What are scheduled banks?

- What do you mean by FDI?

- Tell us some recent international current events.

- As we are seeing China is progressing and we are lagging behind, what do you have to say about it?

- Can you name ASEAN countries?

- What is the difference between REPO and reverse REPO?

- What is CTS (Cheque Truncation System)?

- What is MICR?

- What is KYC?

- What documents are required for KYC?

- What are the eligibility conditions for opening a minor bank account?

RBI-related questions Test your awareness of India’s monetary authority, its history, structure, and policy tools. Questions asked are

- When was the Reserve Bank of India established?

- Under which act was RBI established?

- What was the initial status of RBI?

- When was RBI nationalized?

- Which commission recommended the establishment of RBI?

- Where was RBI’s central office originally located?

- When was RBI headquarters shifted to Mumbai?

- Who was the first governor of RBI?

- Who was the first Indian governor of RBI?

- How many regional offices does RBI have, and where are they located?

- What are the main functions of RBI?

- What instructions did RBI give banks regarding liquidity management?

- What happens when RBI increases the repo rate?

- What happens when RBI decreases the repo rate?

- What is Open Market Operations (OMO)?

- What is the time period of securities under OMO?

- What is the Minimum Reserve System (MRS)?

Questions related to practical banking knowledge, customer handling, and operational clarity.

- What is the main role of a bank?

- What types of banks exist in India?

- What are demand deposits and term deposits?

- Why do banks offer different interest rates on different accounts?

- What happens to inactive bank accounts?

- What options are available for NRIs to open bank accounts?

- How does a bank deal with customers having criminal records?

- How does a bank handle large cash withdrawals?

- What is an overdraft facility?

- Can banks discount bills?

- What is a negotiable instrument?

- What is a check?

- What is the difference between a bearer cheque and an order cheque?

- What is a crossed cheque?

- What happens if the amount in words and figures differs on a check?

- What is a demand draft?

- What happens if there is a mistake in a demand draft?

- Who is responsible if a demand draft fails?

- How does an ATM work?

What questions from NIACL & Insurance are asked in the interview?

These questions evaluate your understanding of NIACL as an organization and the general insurance industry.

- What is NIACL?

- When was NIACL established?

- Who founded NIACL?

- Where is NIACL headquarters located?

- Which ministry governs NIACL?

- What type of insurance company is NIACL?

- What are the major products offered by NIACL?

- Is NIACL present outside India?

- What is NIACL’s market position in India?

- Who regulates NIACL?

- What is the ownership structure of NIACL?

- What is the role of an administrative officer in NIACL?

- Which departments can an AO be posted to?

- What is underwriting in general insurance?

- What is claims settlement?

- What is reinsurance?

- Does NIACL use reinsurance?

- Why is motor insurance important for NIACL?

- How does NIACL contribute to social security schemes?

- What challenges does the general insurance sector face?

- Why do you want to join NIACL as an administrative officer?

- Who is the current chairman and managing director of NIACL?

- What were NIACL’s gross written premium and market share recently?

- How has NIACL performed in recent financial quarters?

What priority sector lending questions are asked in the NIACL AO interview?

Priority Sector Lending questions test awareness of inclusive banking policies framed by RBI. Some of the sample questions are

- Why was Priority Sector Lending introduced?

- What percentage of loans must public sector banks allocate to the priority sector?

- What is Adjusted Net Bank Credit (ANBC)?

- What is the role of agriculture in priority sector lending?

- Who are small and marginal farmers?

- What is a Priority Sector Lending Certificate (PSLC)?

- What is the new definition of MSMEs?

- What are the loan limits for housing under PSL?

- What are the PSL loan limits for renewable energy projects?

Current Affairs Questions asked in NIACL AO Interview

Current affairs questions are asked to check whether the candidate is aware of recent national and international developments, especially those impacting the banking, insurance, economy, and governance sectors.

- What are the major insurance-related developments in the last six months?

- Any recent government schemes related to insurance or financial inclusion?

- What are the recent changes made by IRDAI?

- What recent reforms have been introduced in the insurance sector?

- What are the recent economic challenges India is facing?

- Recent budget announcements related to banking or insurance?

- Any major global economic event affecting India?

- Recent mergers or acquisitions in the financial sector?

- Recent appointments in banking, insurance, or regulatory bodies?

- Recent natural disasters and their impact on the insurance industry?

Claims & Settlement Questions asked in NIACL AO Interview

Claims-related questions are important because claims handling is a core function of NIACL and a common posting area for AOs.

- What is an insurance claim?

- What are the steps involved in claims settlement?

- What documents are required to process a claim?

- What is claim repudiation?

- What is partial loss and total loss?

- How would you handle a fraudulent claim?

- What is third-party motor insurance claim?

- How do you deal with an angry customer during claim settlement?

- What is surveyor’s role in claims?

- Why timely claims settlement is important for an insurer?

Underwriting Questions asked in NIACL AO Interview

Underwriting questions test whether you understand risk assessment, which is the backbone of general insurance.

- What is underwriting?

- Why is underwriting important in insurance?

- What factors are considered during underwriting?

- What is risk assessment?

- What is moral hazard?

- What is adverse selection?

- Difference between standard and sub-standard risks?

- What happens if underwriting is poor?

- How does underwriting impact profitability?

- What underwriting risks exist in motor or health insurance?

Situational Questions asked in NIACL AO Interview

Situational questions test decision-making ability, presence of mind, and practical thinking.

- What will you do if targets are not being met?

- How will you handle multiple tasks with tight deadlines?

- What will you do if a customer complaint escalates?

- How will you deal with a mistake made by your team member?

- What if you disagree with your senior’s decision?

- How will you manage work-life balance?

- What will you do if you are posted in a rural area?

- How will you adapt to frequent transfers?

- What if you are asked to work beyond office hours?

- How will you improve branch performance?

Download NIACL AO Interview Questions and Answers FREE PDF

The free NIACL AO Interview PDF covers all essential aspects of interview preparation, including expected interview questions, topic-wise question lists, preparation tips, dress code guidelines, and expert interview insights. This PDF is designed to help candidates clearly understand the NIACL AO interview process and approach the interview with confidence, clarity, and proper direction.

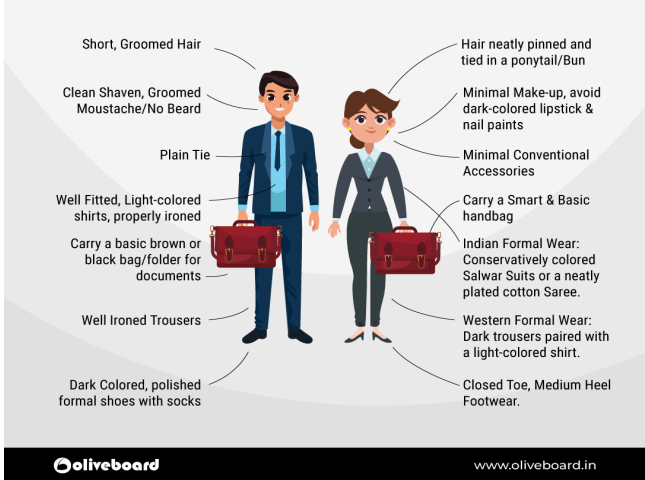

What dress code should candidates follow for the NIACL AO interview?

Your appearance in the NIACL AO interview creates the first impression and reflects your seriousness, professionalism, and suitability for an officer-level role. The interview panel expects candidates to be formally dressed, neat, and well-groomed. Flashy or casual attire should be strictly avoided.

Dress Code for Male Candidates

Male candidates should dress in formal, sober, and professional attire.

- Light-colored formal shirt (white, light blue, light pink preferred)

- Dark-colored formal trousers (black, navy blue, charcoal grey)

- Shirt sleeves should be fully buttoned; avoid folding

- Formal leather shoes (black or brown), well-polished

- Full-length socks matching trousers or shoes

- Belt matching shoe color

- Clean-shaven face or neatly trimmed beard

- Hair neatly trimmed; avoid extreme styles

- Analog wristwatch (no smartwatches or digital watches)

- Avoid rings, bracelets, chains, or visible tattoos

Dress Code for Female Candidates

Female candidates should aim for a simple, elegant, and professional look.

- Saree (plain cotton or silk) if comfortable carrying it

- OR salwar-kameez / kurta-leggings with minimal design

- OR formal shirt and trousers with a blazer

- Neutral or light-colored attire preferred

- Minimal makeup (light kajal, nude lipstick)

- Hair tied neatly (bun or ponytail)

- Closed footwear or low-heel formal shoes

- Minimal jewelry (small earrings, no heavy accessories)

- Analog watch preferred

- Tattoos should be covered

What documents should I carry for the NIACL AO Interview?

Candidates appearing for the NIACL AO interview must carry all required documents in original along with photocopies, neatly arranged in a folder. Carrying complete and correct documents is mandatory, as verification is done before or during the interview process.

- NIACL AO interview call letter

- Valid photo identity proof (Aadhaar Card / PAN Card / Passport / Voter ID)

- Educational qualification certificates and mark sheets

- Caste or category certificate (SC/ST/OBC/EWS), if applicable

- Experience certificate and relieving letter (for working professionals)

- Recent passport-size photographs

What interview etiquette should I follow during the NIACL AO Interview?

The interview panel closely observes a candidate’s professional behavior, discipline, and attitude during the interaction. Following proper interview etiquette helps create a positive and confident impression.

- Reach the interview venue at least 15–20 minutes before the reporting time

- Switch off or keep your mobile phone on silent mode

- Greet the panel members politely on entering the room

- Sit down only when you are asked to do so

- Maintain proper posture and steady eye contact

- Speak clearly, calmly, and confidently

- Listen carefully and do not interrupt the panel

- Avoid overconfidence, casual language, or slang

- Thank the panel members before leaving the room

What things should I avoid while appearing for the NIACL AO Interview?

Avoiding common mistakes is crucial, as even small behavioral lapses can negatively impact your interview performance. The panel expects candidates to be calm, respectful, and professional at all times.

- Wearing casual, flashy, or party-type clothing

- Excessive makeup, heavy jewelry, or unnecessary accessories

- Chewing gum, carrying food, or using mobile phones

- Arguing with or interrupting panel members

- Bluffing or giving false or exaggerated answers

- Speaking negatively about previous employers or organizations

- Nervous gestures like fidgeting, shaking legs, or playing with objects

FAQs

Q1: When will the NIACL AO interview be conducted for 2025–26?

A1: The NIACL AO interview for the 2025–26 recruitment cycle is expected to be held between January and February 2026.

Q2: What is the weightage of the interview in NIACL AO final selection?

A2: The final selection is based on a combined score of the written examination and the interview, as per the official weightage mentioned in the notification.

Q3: What type of questions are asked in the NIACL AO interview?

A3: Questions are asked from personality, banking awareness, RBI, insurance and NIACL-specific topics, priority sector lending, current affairs, and situational scenarios.

Q4: Is banking knowledge necessary for the NIACL AO interview?

A4: Yes, candidates are expected to have basic to moderate knowledge of banking concepts, as insurance operations are closely linked with the banking and financial system.

Q5: What documents should I carry for the NIACL AO interview?

A5: Candidates must carry the interview call letter, valid photo ID, educational certificates, category certificate (if applicable), experience certificate, and photographs.

Q6: What dress code should be followed for the NIACL AO interview?

A6: Candidates should wear formal and professional attire. Casual or flashy clothing should be avoided to maintain a professional appearance.

Q7: Are transfers mandatory after selection as NIACL AO?

A7: Yes, NIACL AOs are transferable posts, and candidates must be willing to serve anywhere in India as per organizational requirements.

Q8: Can I admit that I don’t know an answer in the interview?

A8: Yes, it is better to politely admit if you do not know an answer rather than bluffing or giving incorrect information.

Hi, I’m Tripti, a senior content writer at Oliveboard, where I manage blog content along with community engagement across platforms like Telegram and WhatsApp. With 3+ years of experience in content and SEO optimization related to banking exams, I have led content for popular exams like SSC, banking, railways, and state exams.