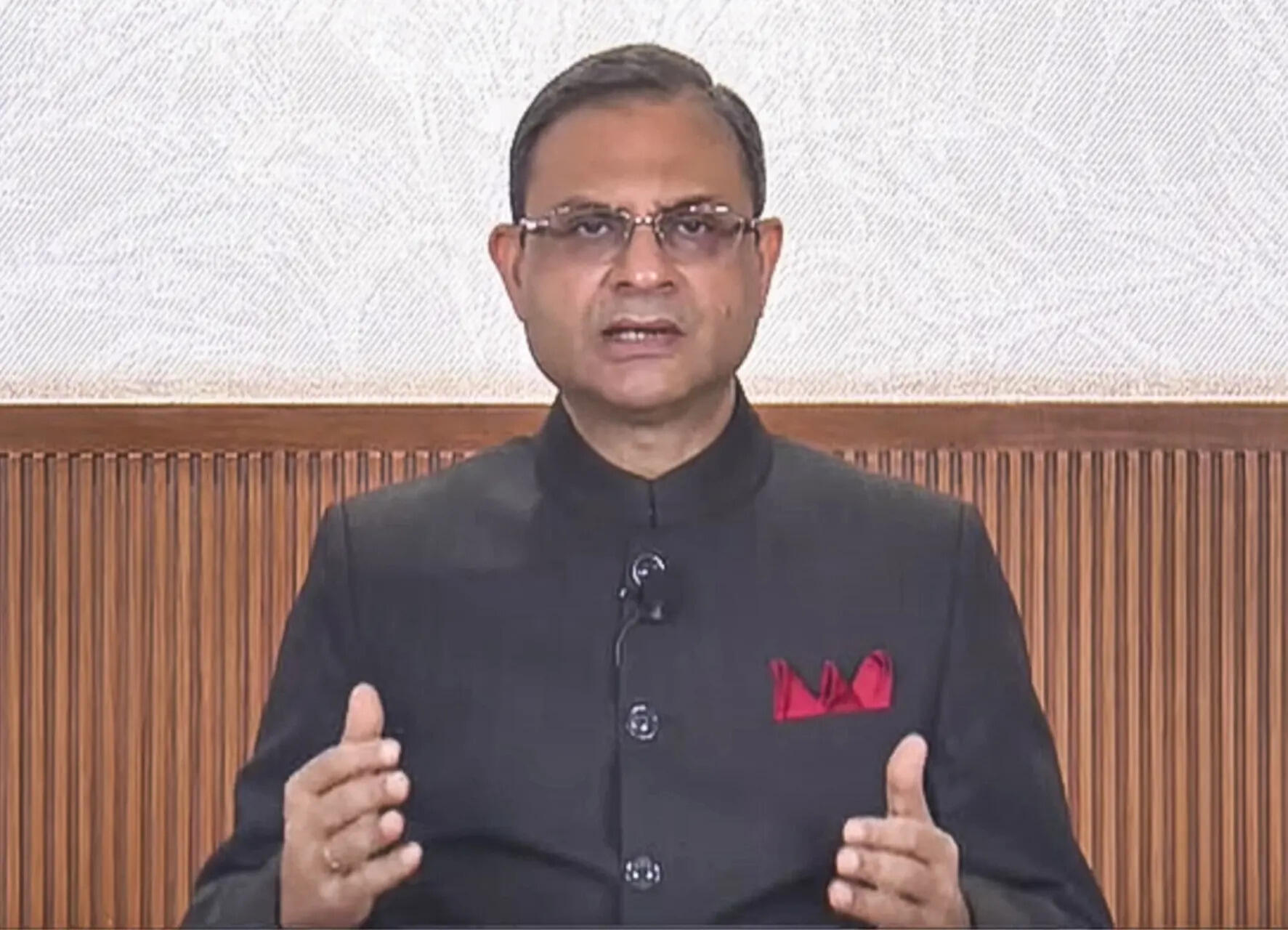

Reserve Bank of India (RBI) Governor Sanjay Malhotra on Friday reiterated that the central bank does not target any specific exchange-rate level for the rupee and allows markets to primarily determine its value, intervening only to manage “abnormal or excessive volatility”.

Responding to a question during the post-MPC press briefing on whether the currency was undervalued and the RBI’s approach to the exchange rate, Malhotra said the central bank’s position has remained consistent. “Our stated policy has always been that we allow the markets to determine… we don’t target any price levels or any bands. We allow the markets to determine the prices,” he said.

He stressed that the domestic foreign-exchange market is “very efficient” in the long run and deep enough to absorb movements. Citing recent fluctuations, Malhotra noted that the rupee had weakened to “almost 88” against the US dollar earlier in February but recovered within three months to below 84. “These fluctuations, this volatility, does happen, can happen,” he said.

The Governor added that the RBI’s intervention is aimed solely at preventing disorderly movements. “Our effort has always been to reduce any abnormal or excessive volatility. And that is what we will continue to endeavour,” he stated.

Malhotra said India’s external sector remains strong, supported by “sufficient reserves” and a current account position that is “very manageable at about 1% or so”. With strong fundamentals, he said the country should continue to attract “good capital flows” going forward.

Earlier in the day the RBI announced that it will inject durable liquidity in December through large government bond purchases via OMOs and a three‑year dollar–rupee buy–sell swap. It stated that it will conduct open-market purchases of government securities totalling ₹1 lakh crore in December to ease liquidity conditions and support transmission. RBI said it will also run a three‑year USD/INR buy–sell forex swap of $5 billion, in which it provides rupees now against dollars and reverses the leg after three years.

Responding to a question on the role of dollar–rupee swaps, Governor Sanjay Malhotra clarified that the instrument was being used purely as a liquidity tool and not as a mechanism to influence the exchange rate. “It’s more of a liquidity measure… it’s not to support the rupee,” he said, emphasising that the RBI does not target any specific level for the currency and only seeks to ensure “an orderly movement” in the market.